Résumé :

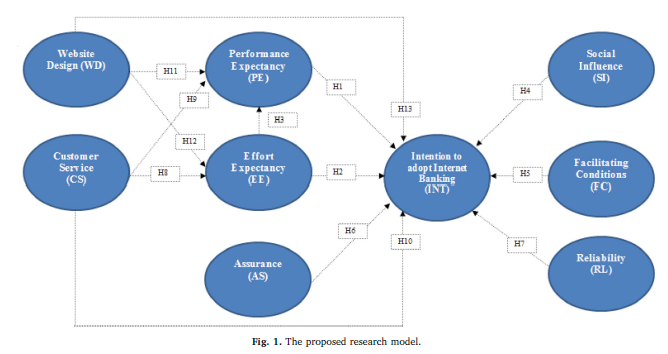

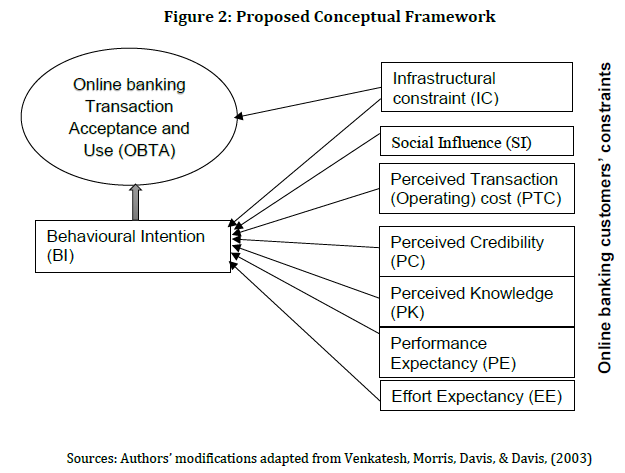

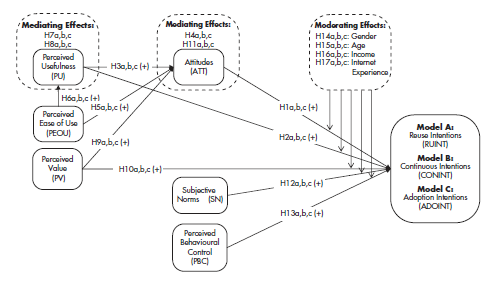

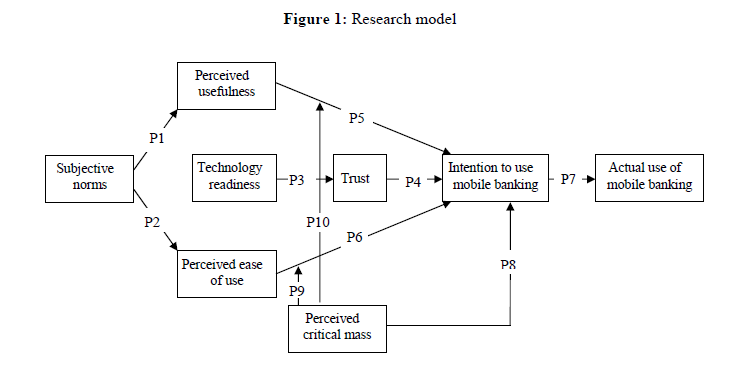

The purpose of this study is to investigate the behavioral intention to adopt internet banking (IB) by individuals under the influence of user espoused cultural values in Fiji. A conceptual framework is developed by extending the Unified Theory of Acceptance and Use of Technology (UTAUT) model, incorporating customer satisfaction and perceived risk constructs and cultural moderators of individualism and uncertainty avoidance. This research adopts a quantitative approach and collects data from 530 respondents. The proposed model is tested using structural equation modelling. The empirical results obtained suggest that IB adoption is positively influenced by the levels of performance expectancy, effort expectancy, social influence and facilitating conditions while perceived risk negatively influences IB usage intention. IB intention was found to positively impact usage behavior

which ultimately impacts customer satisfaction. This study also reveals that uncertainty avoidance dampens the influence of performance expectancy and facilitating conditions on IB adoption intention. The study highlights the importance of individual’s cultural values in promoting IB adoption. It contributes to the literature by extending and testing a comprehensive research model to better understand IB behavior.

Mots-clés : Internet banking, UTAUT, perceived risk, customer satisfaction, behavioral intention, usage behavior, culture, Fiji.

Conclusion :

This study was carried out with the goal of identifying and examining factors that impact customers’ intention to adopt IB from a developing country perspective. It extends the UTAUT model with the addition of PR, CS and Hofstede’s cultural dimensions of IDV and UA constructs. Despite Fiji having one of the highest levels of internet penetration in the

Pacific, IB adoption is still in its early stages. Through the collection of data from 530 respondents in the country, this study was able to deliver a conceptual model that explains 76 % of the variance in extended UTAUT model. Results indicated that that IB adoption is positively influenced by the levels of PE, EE, SI, FC while PR negatively influences adoption intention. IB was also found to positively impact UB which in turn has an effect on CS. In addition, UA was found to moderate the relationship of PE and FC on IB adoption intention. The study has contributed theoretically and practically to IB research.

Bibliographie :

Abbasi, M. S., Tarhini, A., Elyas, T., & Shah, F. (2015). Impact of individualism and

collectivism over the individual’s technology acceptance behaviour: A multi-group

analysis between Pakistan and Turkey. Journal of Enterprise Information Management,

28(6), 747–768.

AbuShanab, E., Pearson, J. M., & Setterstrom, A. J. (2010). Internet banking and customers’

acceptance in Jordan: The unified model’s perspective. Communications of the

Association for Information Systems, 26(1), 23.

Ajzen, I. (1991). The theory of planned behaviour. Organizational Behaviour and Human

Decision Processes, 50(2), 179–211.

Al Kailani, M., & Kumar, R. (2011). Investigating uncertainty avoidance and perceived

risk for impacting Internet buying: A study in three national cultures. International

Journal of Business and Management, 6(5), 76.

Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of

mobile banking by Jordanian bank customers: Extending UTAUT2 with trust.

International Journal of Information Management, 37(3), 99–110.

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., & Algharabat, R. (2018). Examining factors

influencing Jordanian customers’ intentions and adoption of internet banking:

Extending UTAUT2 with risk. Journal of Retailing and Consumer Services, 40, 125–138.

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., Lal, B., & Williams, M. D. (2015). Consumer

adoption of Internet banking in Jordan: Examining the role of hedonic motivation,

habit, self-efficacy and trust. Journal of Financial Services Marketing, 20(2), 145–157.

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., & Williams, M. D. (2016). Consumer adoption

of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived

risk and self-efficacy. Journal of Enterprise Information Management, 29(1), 118–139.

Aldás-Manzano, J., Lassala-Navarré, C., Ruiz-Mafé, C., & Sanz-Blas, S. (2009). The role of

consumer innovativeness and perceived risk in online banking usage. International

Journal of Bank Marketing, 27(1), 53–75.

Alhirz, H., & Sajeev, A. (2015). Do cultural dimensions differentiate ERP acceptance? A

study in the context of Saudi Arabia. Information Technology and People, 28(1),

163–194.

Al-Smadi, M. O. (2012). Factors affecting adoption of electronic banking: An analysis of

the perspectives of banks’ customers. International Journal of Research in Business and

Social Science, 3(17), 294.

Al-Somali, S. A., Gholami, R., & Clegg, B. (2009). An investigation into the acceptance of

online banking in Saudi Arabia. Technovation, 29(2), 130–141.

Alvesson, M., & Kärreman, D. (2007). Constructing mystery: Empirical matters in theory

development. The Academy of Management Review, 32(4), 1265–1281.

Amin, M. (2016). Internet banking service quality and its implication on e-customer satisfaction

and e-customer loyalty. International Journal of Bank Marketing.

Arnould, E. J., & Thompson, C. J. (2005). Consumer culture theory (CCT): Twenty years

of research. The Journal of Consumer Research, 31(4), 868–882.

Ashraf, A. R., Thongpapanl, N., & Auh, S. (2014). The application of the technology acceptance

model under different cultural contexts: The case of online shopping

adoption. Journal of International Marketing, 22(3), 68–93.

Ayo, C. K., Oni, A. A., Adewoye, O. J., & Eweoya, I. O. (2016). E-banking users’ behaviour:

E-service quality, attitude, and customer satisfaction. International Journal of Bank

Marketing, 34(3), 347–367.

Baabdullah, A. M., Rana, N. P., Alalwan, A. A., Islam, R., Patil, P., & Dwivedi, Y. K.

(2019). Consumer adoption of self-service technologies in the context of the

Jordanian banking industry: Examining the moderating role of channel types.

Information Systems Management, 36(4), 286–305.

Baptista, G., & Oliveira, T. (2015). Understanding mobile banking: The unified theory of

acceptance and use of technology combined with cultural moderators. Computers in

Human Behavior, 50, 418–430.

Baskerville, R. F. (2003). Hofstede never studied culture. Accounting Organizations and

Society, 28(1), 1–14.

Bauer, R. A., & Cox, D. F. (1967). Risk taking and information handling in consumer behavior.

Boston: Harvard University469–486.

Blut, M., Wang, C., & Schoefer, K. (2016). Factors influencing the acceptance of selfservice

technologies: A meta-analysis. Journal of Service Research, 19(4), 396–416.

Boateng, H., Adam, D. R., Okoe, A. F., & Anning-Dorson, T. (2016). Assessing the determinants

of internet banking adoption intentions: A social cognitive theory perspective.

Computers in Human Behavior, 65, 468–478.

Brown, S. A., Dennis, A. R., & Venkatesh, V. (2010). Predicting collaboration technology

use: Integrating technology adoption and collaboration research. Journal of

Management Information Systems, 27(2), 9–54.

Calhoun, K. J., Teng, J. T., & Cheon, M. J. (2002). Impact of national culture on

information technology usage behaviour: An exploratory study of decision making in

Korea and the USA. Behaviour & Information Technology, 21(4), 293–302.

Cardon, P. W., & Marshall, B. A. (2008). National culture and technology acceptance: The

impact of uncertainty avoidance. Issues in Information Systems, 9(2), 103–110.

Celik, H. (2008). What determines Turkish customers’ acceptance of internet banking?

International Journal of Bank Marketing, 26(5), 353–370.

Chaouali, W., Yahia, I. B., & Souiden, N. (2016). The interplay of counter-conformity

motivation, social influence, and trust in customers’ intention to adopt Internet

banking services: The case of an emerging country. Journal of Retailing and Consumer

Services, 28, 209–218.

Chauhan, V., Yadav, R., & Choudhary, V. (2019). Analyzing the impact of consumer innovativeness

and perceived risk in internet banking adoption: A study of Indian

consumers. International Journal of Bank Marketing, 37(1), 323–339.

Cheng, J. M. S., Sheen, G. J., & Lou, G. C. (2006). Consumer acceptance of the internet as

a channel of distribution in Taiwan—A channel function perspective. Technovation,

26(7), 856–864.

Chin, W. W. (2010). How to write up and report PLS analyses. Handbook of artial least

squares. Berlin, Heidelberg: Springer655–690.

Chin, W. W., Peterson, R. A., & Brown, S. P. (2008). Structural equation modeling in

marketing: Some practical reminders. The Journal of Marketing Theory and Practice,

16(4), 287–298.

Chiou, J. S., & Shen, C. C. (2012). The antecedents of online financial service adoption:

The impact of physical banking services on Internet banking acceptance. Behaviour &

Information Technology, 31(9), 859–871.

Chiu, C. M., Chiu, C. S., & Chang, H. C. (2007). Examining the integrated influence of

fairness and quality on learners’ satisfaction and web‐based learning continuance

intention. Information Systems Journal, 17(3), 271–287.

Chong, A. Y. L., Chan, F. T., & Ooi, K. B. (2012). Predicting consumer decisions to adopt

mobile commerce: Cross country empirical examination between China and

Malaysia. Decision Support Systems, 53(1), 34–43.

Chopdar, P. K., & Sivakumar, V. (2019). Understanding continuance usage of mobile

shopping applications in India: The role of espoused cultural values and perceived

risk. Behaviour & Information Technology, 38(1), 42–64.

Corbitt, B. J., Thanasankit, T., & Yi, H. (2003). Trust and e-commerce: A study of consumer

perceptions. Electronic Commerce Research and Applications, 2(3), 203–215.

Cyr, D. (2013). Website design, trust and culture: An eight country investigation.

Electronic Commerce Research and Applications, 12(6), 373–385.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of

information technology. MIS Quarterly, 13(3), 319–340.

Dodds, W. B., Monroe, K. B., & Grewal, D. (1991). Effects of price, brand, and store

information on buyers’ product evaluations. Journal of Marketing Research, 28(3),

307–319.

Dwivedi, Y. K., Rana, N. P., Jeyaraj, A., Clement, M., & Williams, M. D. (2019). Reexamining

the unified theory of acceptance and use of technology (UTAUT): Towards

a revised theoretical model. Information Systems Frontiers, 21(3), 719–734.

Eriksson, K., & Nilsson, D. (2007). Determinants of the continued use of self-service

technology: The case of Internet banking. Technovation, 27(4), 159–167.

Eriksson, K., Kerem, K., & Nilsson, D. (2005). Customer acceptance of internet banking in

Estonia. International Journal of Bank Marketing, 23(2), 200–216.

Farah, M. F. (2017). Consumers’ switching motivations and intention in the case of bank

mergers: A cross-cultural study. International Journal of Bank Marketing, 35(2),

254–274.

Featherman, M. S., & Pavlou, P. A. (2003). Predicting e-services adoption: A perceived

risk facets perspective. International Journal of Human-computer Studies, 59(4),

451–474.

Finau, G., Rika, N., Samuwai, J., & McGoon, J. (2016). Perceptions of digital financial

services in rural Fiji. Information Technologies and International Development, 12(4),

11–21.

Flavián, C., Guinalíu, M., & Gurrea, R. (2006). The role played by perceived usability,

satisfaction and consumer trust on website loyalty. Information & Management, 43(1),

1–14.

Frijns, B., Gilbert, A., Lehnert, T., & Tourani-Rad, A. (2013). Uncertainty avoidance, risk

tolerance and corporate takeover decisions. Journal of Banking & Finance, 37(7),

2457–2471.

Fullerton, G., & Taylor, S. (2015). Dissatisfaction and violation: Two distinct consequences

of the wait experience. Journal of Service Theory and Practice, 25(1), 31–50.

Guimaraes, T., Yoon, Y., & Clevenson, A. (1996). Factors important to expert systems

success a field test. Information & Management, 30(3), 119–130.

Gupta, A., Dogra, N., & George, B. (2018). What determines tourist adoption of smartphone

apps? An analysis based on the UTAUT-2 framework. Journal of Hospitality and

Tourism Technology, 9(1), 50–64.

Hair, J., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate data analysis.

New Jersey: Hoboken: Pearson Education.

Hanafizadeh, P., & Khedmatgozar, H. R. (2012). The mediating role of the dimensions of

the perceived risk in the effect of customers’ awareness on the adoption of Internet

banking in Iran. Electronic Commerce Research, 12(2), 151–175.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2012). Using partial least squares path modeling

in advertising research: Basic concepts and recent issues. Handbook of research on international

advertising. Edward Elgar Publishing.

Hoehle, H., Zhang, X., & Venkatesh, V. (2015). An espoused cultural perspective to understand

continued intention to use mobile applications: A four-country study of

mobile social media application usability. European Journal of Information Systems,

24(3), 337–359.

Hoffman, D. L., Novak, T. P., & Peralta, M. A. (1999). Information privacy in the marketspace:

Implications for the commercial uses of anonymity on the Web. The

Information Society, 15(2), 129–139.

Hofstede, G. (1980). Culture’s consequences, international differences in work-related values.

Beverly Hills: Sage Publications.

Hofstede, G. (1994). Values survey module 1994 manual. The Netherlands: Institute for

Research on Intercultural Cooperation, Maastrict.

Hofstede, G. (2011). Dimensionalizing cultures: The Hofstede model in context. Online

Readings in Psychology and Culture, 2(1), 8.

Hsiao, C. H., Chang, J. J., & Tang, K. Y. (2016). Exploring the influential factors in

continuance usage of mobile social Apps: Satisfaction, habit, and customer value

perspectives. Telematics and Informatics, 33(2), 342–355.

Hung, C. L., & Chou, J. C. L. (2014). Examining the cultural moderation on the acceptance

of mobile commerce. International Journal of Innovation and Technology Management,

11(02).

Hwang, Y., & Lee, K. C. (2012). Investigating the moderating role of uncertainty avoidance

cultural values on multidimensional online trust. Information & Management,

49(3-4), 171–176.

Im, I., Hong, S., & Kang, M. S. (2011). An international comparison of technology

adoption: Testing the UTAUT model. Information & Management, 48(1), 1–8.

Jaruwachirathanakul, B., & Fink, D. (2005). Internet banking adoption strategies for a

developing country: The case of Thailand. Internet Research, 15(3), 295–311.

Jarvenpaa, S. L., Tractinsky, N., & Saarinen, L. (1999). Consumer trust in an Internet

store: A cross-cultural validation. Journal of Computer-Mediated Communication, 5(2),

48–65.

Johns, G. (2006). The essential impact of context on organizational behavior. The

Academy of Management Review, 31(2), 386–408.

Kaabachi, S., Ben Mrad, S., & O’Leary, B. (2019). Consumer’s initial trust formation in

IOB’s acceptance: The role of social influence and perceived compatibility.

International Journal of Bank Marketing, 37(2), 507–530.

Kaba, B., & Touré, B. (2014). Understanding information and communication technology

behavioral intention to use: Applying the UTAUT model to social networking site

adoption by young people in a least developed country. Journal of the Association for

Information Science and Technology, 65(8), 1662–1674.

Kalinic, Z., & Marinkovic, V. (2016). Determinants of users’ intention to adopt m-commerce:

An empirical analysis. Information Systems and E-Business Management, 14(2),

367–387.

Kesharwani, A., & Singh Bisht, S. (2012). The impact of trust and perceived risk on internet

banking adoption in India: An extension of technology acceptance model.

International Journal of Bank Marketing, 30(4), 303–322.

Khan, I. U., Hameed, Z., & Khan, S. U. (2017). Understanding online banking adoption in

a developing country: UTAUT2 with cultural moderators. Journal of Global

Information Management, 25(1), 43–65.

Khedmatgozar, H. R., & Shahnazi, A. (2018). The role of dimensions of perceived risk in

adoption of corporate internet banking by customers in Iran. Electronic Commerce

Research, 18(2), 389–412.

Kim, S. H., & Park, H. J. (2011). Effects of social influence on consumers’ voluntary

adoption of innovations prompted by others. Journal of Business Research, 64(11),

1190–1194.

Kim, H. B., Kim, T. T., & Shin, S. W. (2009). Modeling roles of subjective norms and eTrust

in customers’ acceptance of airline B2C eCommerce websites. Tourism Management,

30(2), 266–277.

Kim, H., Schroeder, A., & Pennington-Gray, L. (2016). Does culture influence risk perceptions?

Tourism Review International, 20(1), 11–28.

Kim, K. K., Shin, H. K., & Kim, B. (2011). The role of psychological traits and social factors

in using new mobile communication services. Electronic Commerce Research and

Applications, 10(4), 408–417.

Koenig-Lewis, N., Palmer, A., & Moll, A. (2010). Predicting young consumers’ take up of

mobile banking services. International Journal of Bank Marketing, 28(5), 410–432.

Koller, M. (1988). Risk as a determinant of trust. Basic and Applied Social Psychology, 9(4),

265–276.

Kumar, R., Sachan, A., & Kumar, R. (2020). The impact of service delivery system process

and moderating effect of perceived value in internet banking adoption. Australasian

Journal of Information Systems, 24.

Ladhari, R., Pons, F., Bressolles, G., & Zins, M. (2011). Culture and personal values: How

they influence perceived service quality. Journal of Business Research, 64(9), 951–957.

Lai, C., Wang, Q., Li, X., & Hu, X. (2016). The influence of individual espoused cultural

values on self-directed use of technology for language learning beyond the classroom.

Computers in Human Behavior, 62, 676–688.

Lance, C. E. (1988). Residual centering, exploratory and confirmatory moderator analysis,

and decomposition of effects in path models containing interactions. Applied

Psychological Measurement, 12(2), 163–175.

Lassar, W. M., Manolis, C., & Lassar, S. S. (2005). The relationship between consumer

innovativeness, personal characteristics, and online banking adoption. International

Journal of Bank Marketing, 23(2), 176–199.

Laukkanen, T. (2015). How uncertainty avoidance affects innovation resistance in mobile

banking: The moderating role of age and gender. 2015 48th Hawaii International

Conference on System Sciences (pp. 3601–3610).

Lee, M. C. (2009). Factors influencing the adoption of internet banking: An integration of

TAM and TPB with perceived risk and perceived benefit. Electronic Commerce

Research and Applications, 8(3), 130–141.

Lee, I., Choi, B., Kim, J., & Hong, S. J. (2007). Culture-technology fit: Effects of cultural

characteristics on the post-adoption beliefs of mobile internet users. International

Journal of Electronic Commerce, 11(4), 11–51.

Lee, S. G., Trimi, S., & Kim, C. (2013). The impact of cultural differences on technology

adoption. Journal of World Business, 48(1), 20–29.

Leidner, D. E., & Kayworth, T. (2006). A review of culture in information systems research:

Toward a theory of information technology culture conflict. MIS Quarterly,

30(2), 357–399.

Lifen Zhao, A., Hanmer-Lloyd, S., Ward, P., & Goode, M. M. (2008). Perceived risk and

Chinese consumers’ internet banking services adoption. International Journal of Bank

Marketing, 26(7), 505–525.

Lim, N., Yeow, P. H., & Yuen, Y. Y. (2010). An online banking security framework and a

cross-cultural comparison. Journal of Global Information Technology Management,

13(3), 39–62.

Lin, H. C. (2014). An investigation of the effects of cultural differences on physicians’

perceptions of information technology acceptance as they relate to knowledge

management systems. Computers in Human Behavior, 38, 368–380.

López-Nicolás, C., Molina-Castillo, F. J., & Bouwman, H. (2008). An assessment of advanced

mobile services acceptance: Contributions from TAM and diffusion theory

models. Information & Management, 45(6), 359–364.

Lu, J. (2014). Are personal innovativeness and social influence critical to continue with

mobile commerce? Internet Research, 24(2), 134–159.

Lu, J., Yu, C. S., & Liu, C. (2009). Mobile data service demographics in urban China.

Journal of Computer Information Systems, 50(2), 117–126.

Lu, J., Liu, C., & Wei, J. (2017). How important are enjoyment and mobility for mobile

applications? Journal of Computer Information Systems, 57(1), 1–12.

Lu, J., Yu, C. S., Liu, C., & Wei, J. (2017). Comparison of mobile shopping continuance

intention between China and USA from an espoused cultural perspective. Computers

in Human Behavior, 75, 130–146.

Luo, C., Wu, J., Shi, Y., & Xu, Y. (2014). The effects of individualism–collectivism cultural

orientation on eWOM information. International Journal of Information Management,

34(4), 446–456.

Luo, X., Li, H., Zhang, J., & Shim, J. P. (2010). Examining multi-dimensional trust and

multi-faceted risk in initial acceptance of emerging technologies: An empirical study

of mobile banking services. Decision Support Systems, 49(2), 222–234.

Magnusson, P., Peterson, R., & Westjohn, S. A. (2014). The influence of national cultural

values on the use of rewards alignment to improve sales collaboration. International

Marketing Review, 31(1), 30–50.

Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A

developing country perspective. Computers in Human Behavior, 54, 453–461.

Marafon, D. L., Basso, K., Espartel, L. B., de Barcellos, M. D., & Rech, E. (2018). Perceived

risk and intention to use internet banking: The effects of self-confidence and risk

acceptance. International Journal of Bank Marketing, 36(2), 277–289.

Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking

adoption: A unified theory of acceptance and use of technology and perceived risk

application. International Journal of Information Management, 34(1), 1–13.

Matsuo, M., Minami, C., & Matsuyama, T. (2018). Social influence on innovation resistance

in internet banking services. Journal of Retailing and Consumer Services, 45,

42–51.

McCoy, S. (2003). The effect of national culture dimensions on the acceptance of information

and technology: A trait based approach.

Morosan, C., & DeFranco, A. (2016). It’s about time: Revisiting UTAUT2 to examine

consumers’ intentions to use NFC mobile payments in hotels. International Journal of

Hospitality Management, 53, 17–29.

Namahoot, K. S., & Laohavichien, T. (2018). Assessing the intentions to use internet

banking: The role of perceived risk and trust as mediating factors. International

Journal of Bank Marketing, 36(2), 256–276.

Ng, C. S. P. (2013). Intention to purchase on social commerce websites across cultures: A

cross-regional study. Information & Management, 50(8), 609–620.

Nikbin, D., Ismail, I., & Marimuthu, M. (2012). The impact of causal attributions on

customer satisfaction and switching intention: Empirical evidence from the airline

industry. Journal of Air Transport Management, 25, 37–39.

Park, C., Jun, J., & Lee, T. (2015). Consumer characteristics and the use of social networking

sites: A comparison between Korea and the US. International Marketing

Review, 32(3/4), 414–437.

Patel, K. J., & Patel, H. J. (2018). Adoption of internet banking services in Gujarat: An

extension of TAM with perceived security and social influence. International Journal of

Bank Marketing, 36(1), 147–169.

Pavlou, P. (2001). Integrating trust in electronic commerce with the technology acceptance

model: Model development and validation. AMCIS 2001 Proceedings, 159.

Peter, J. P., & Ryan, M. J. (1976). An investigation of perceived risk at the brand level.

Journal of Marketing Research, 13(2), 184–188.

Petter, S., DeLone, W., & McLean, E. (2008). Measuring information systems success:

Models, dimensions, measures, and interrelationships. European Journal of

Information Systems, 17(3), 236–263.

Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance

of online banking: An extension of the technology acceptance model. Internet

Research, 14(3), 224–235.

Poromatikul, C., De Maeyer, P., Leelapanyalert, K., & Zaby, S. (2019). Drivers of continuance

intention with mobile banking apps. International Journal of Bank Marketing,

38(1), 242–262.

Qi Dong, J. (2009). User acceptance of information technology innovations in the Chinese

cultural context. Asian Journal of Technology Innovation, 17(2), 129–149.

Rahi, S., Ghani, M. A., & Ngah, A. H. (2019). Factors propelling the adoption of internet

banking: The role of E-Customer service, Website design, brand image and customer

satisfaction. International Journal of Business Information Systems Strategies.

Rahi, S., Mansour, M. M. O., Alghizzawi, M., & Alnaser, F. M. (2019). Integration of

UTAUT model in internet banking adoption context. Journal of Research in Interactive

Marketing, 13(3), 411–435.

Rai, A., Maruping, L. M., & Venkatesh, V. (2009). Offshore information systems project

success: The role of social embeddedness and cultural characteristics. MIS Quarterly,

33(3), 617–641.

Rana, N. P., Dwivedi, Y. K., Lal, B., Williams, M. D., & Clement, M. (2017). Citizens’

adoption of an electronic government system: Towards a unified view. Information

Systems Frontiers, 19(3), 549–568.

Rawashdeh, A. (2015). Factors affecting adoption of internet banking in Jordan:

Chartered accountant’s perspective. International Journal of Bank Marketing, 33(4),

510–529.

Rehman, Z. U., Baharun, R., & Salleh, N. Z. M. (2020). Antecedents, consequences, and

reducers of perceived risk in social media: A systematic literature review and directions

for further research. Psychology & Marketing, 37(1), 74–86.

Reinecke, K., & Bernstein, A. (2013). Knowing what a user likes: A design science approach

to interfaces that automatically adapt to culture. MIS Quarterly, 37(2),

427–453.

Riffai, M., Grant, K., & Edgar, D. (2012). Big TAM in Oman: Exploring the promise of

online banking, its adoption by customers and the challenges of banking in Oman.

International Journal of Information Management, 32(3), 239–250.

Riquelme, H. E., & Rios, R. E. (2010). The moderating effect of gender in the adoption of

mobile banking. International Journal of Bank Marketing, 28(5), 328–341.

Rod, M., Ashill, N. J., Shao, J., & Carruthers, J. (2009). An examination of the relationship

between service quality dimensions, overall internet banking service quality and

customer satisfaction. Marketing Intelligence & Planning, 27(1), 103–126.

Rodrigues, L. F., Oliveira, A., & Costa, C. J. (2016). Does ease-of-use contributes to the

perception of enjoyment? A case of gamification in e-banking. Computers in Human

Behavior, 61, 114–126.

Roy, S. K., Balaji, M., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking

adoption in India: A perceived risk perspective. Journal of Strategic Marketing, 25(5-

6), 418–438.

Sabiote, C. M., Frías, D. M., & Castañeda, J. A. (2012). The moderating effect of uncertainty-

avoidance on overall perceived value of a service purchased online. Internet

Research, 22(2), 180–198.

Sampaio, C. H., Ladeira, W. J., & Santini, F. D. O. (2017). Apps for mobile banking and

customer satisfaction: A cross-cultural study. International Journal of Bank Marketing,

35(7), 1133–1153.

Schepers, J., & Wetzels, M. (2007). A meta-analysis of the technology acceptance model:

Investigating subjective norm and moderation effects. Information & Management,

44(1), 90–103.

Sekaran, U., & Bougie, R. (2010). Theoretical framework in theoretical framework and

hypothesis development. Research Methods for Business: A Skill Building Approach, 80,

13–25.

Sekhon, H. S., Roy, S. K., & Devlin, J. (2016). Perceptions of fairness in financial services:

An analysis of distribution channels. International Journal of Bank Marketing, 34(2),

171–190.

Seock, Y. K., & Bailey, L. R. (2008). The influence of college students’ shopping orientations

and gender differences on online information searches and purchase behaviours.

International Journal of Consumer Studies, 32(2), 113–121.

Shahin Sharifi, S., & Rahim Esfidani, M. (2014). The impacts of relationship marketing on

cognitive dissonance, satisfaction, and loyalty: The mediating role of trust and cognitive

dissonance. International Journal of Retail & Distribution Management, 42(6),

553–575.

Shankar, A., Jebarajakirthy, C., & Ashaduzzaman, M. (2020). How do electronic word of

mouth practices contribute to mobile banking adoption? Journal of Retailing and

Consumer Services, 52, 101920.

Sharma, S., Singh, G., & Aiyub, A. S. (2020). Use of social networking sites by SMEs to

engage with their customers: A developing country perspective. Journal of Internet

Commerce, 19(1), 62–81.

Shih, Y. Y., & Fang, K. (2004). The use of a decomposed theory of planned behavior to

study Internet banking in Taiwan. Internet Research, 14(3), 213–223.

Shiu, E., Walsh, G., Hassan, L. M., & Parry, S. (2015). The direct and moderating influences

of individual-level cultural values within web engagement: A multi-country

analysis of a public information website. Journal of Business Research, 68(3), 534–541.

Smith, A., & Reynolds, N. (2009). Affect and cognition as predictors of behavioral intentions

towards services. International Marketing Review, 26(6), 580–600.

Srite, M., & Karahanna, E. (2006). The role of espoused national cultural values in

technology acceptance. MIS Quarterly, 33(3), 679–704.

Straub, D., Boudreau, M. C., & Gefen, D. (2004). Validation guidelines for IS positivist

research. Communications of the Association for Information Systems, 13(1), 24.

Straub, D., Loch, K., Evaristo, R., Karahanna, E., & Srite, M. (2002). Toward a theorybased

measurement of culture. Journal of Global Information Management, 10(1),

13–23.

Sum Chau, V., & Ngai, L. W. (2010). The youth market for internet banking services:

Perceptions, attitude and behaviour. Journal of Services Marketing, 24(1), 42–60.

Sun, H., & Zhang, P. (2006). The role of moderating factors in user technology acceptance.

International Journal of Human-computer Studies, 64(2), 53–78.

Takieddine, S., & Sun, J. (2015). Internet banking diffusion: A country-level analysis.

Electronic Commerce Research and Applications, 14(5), 361–371.

Tam, C., & Oliveira, T. (2016). Understanding the impact of m-banking on individual

performance: DeLone & McLean and TTF perspective. Computers in Human Behavior,

61, 233–244.

Tam, C., & Oliveira, T. (2019). Does culture influence m-banking use and individual

performance? Information & Management, 56(3), 356–363.

Taras, V., Rowney, J., & Steel, P. (2009). Half a century of measuring culture: Review of

approaches, challenges, and limitations based on the analysis of 121 instruments for

quantifying culture. Journal of International Management, 15(4), 357–373.

Tarhini, A., El-Masri, M., Ali, M., & Serrano, A. (2016). Extending the UTAUT model to

understand the customers’ acceptance and use of internet banking in Lebanon: A

structural equation modeling approach. Information Technology and People, 29(4),

830–849.

Tarhini, A., Hone, K., Liu, X., & Tarhini, T. (2017). Examining the moderating effect of

individual-level cultural values on users’ acceptance of E-learning in developing

countries: A structural equation modeling of an extended technology acceptance

model. Interactive Learning Environments, 25(3), 306–328.

Tran, L. T. T., Pham, L. M. T., & Le, L. T. (2019). E-satisfaction and continuance intention:

The moderator role of online ratings. International Journal of Hospitality Management,

77, 311–322.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of

information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478.

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information

technology: Extending the unified theory of acceptance and use of technology. MIS

Quarterly, 36(1), 157–178.

Venkatesh, V., & Zhang, X. (2010). Unified theory of acceptance and use of technology:

US vs. China. Journal of Global Information Technology Management, 13(1), 5–27.

Yang, A. S. (2009). Exploring adoption difficulties in mobile banking services. Canadian

Journal of Administrative Sciences/Revue Canadienne des Sciences de l’Administration,

26(2), 136–149.

Yiu, C. S., Grant, K., & Edgar, D. (2007). Factors affecting the adoption of Internet

Banking in Hong Kong—Implications for the banking sector. International Journal of

Information Management, 27(5), 336–351.

Yoon, C. (2010). Antecedents of customer satisfaction with online banking in China: The

effects of experience. Computers in Human Behavior, 26(6), 1296–1304.

Yu, C. S. (2012). Factors affecting individuals to adopt mobile banking: Empirical evidence

from the UTAUT model. Journal of Electronic Commerce Research, 13(2), 104.

Yuen, Y., Yeow, P. H., Lim, N., & Saylani, N. (2010). Internet banking adoption:

Comparing developed and developing countries. Journal of Computer Information

Systems, 51(1), 52–61.

Yuen, Y. Y., Yeow, P. H., & Lim, N. (2015). Internet banking acceptance in the United

States and Malaysia: A cross-cultural examination. Marketing Intelligence & Planning,

33(3), 292–308.

YuSheng, K., & Ibrahim, M. (2019). Service innovation, service delivery and customer

satisfaction and loyalty in the banking sector of Ghana. International Journal of Bank

Marketing, 37(5), 1215–1233.

Zhang, K. Z., Cheung, C. M., & Lee, M. K. (2014). Examining the moderating effect of

inconsistent reviews and its gender differences on consumers’ online shopping decision.

International Journal of Information Management, 34(2), 89–98.

Zhang, Y., Weng, Q., & Zhu, N. (2018). The relationships between electronic banking

adoption and its antecedents: A meta-analytic study of the role of national culture.

International Journal of Information Management, 40, 76–87.

Zheng, X., El Ghoul, S., Guedhami, O., & Kwok, C. C. (2013). Collectivism and corruption

in bank lending. Journal of International Business Studies, 44(4), 363–390.

Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile

banking user adoption. Computers in Human Behavior, 26(4), 760–767.

Zhou, Z., Jin, X. L., Fang, Y., & Vogel, D. (2015). Toward a theory of perceived benefits,

affective commitment, and continuance intention in social virtual worlds: Cultural

values (indulgence and individualism) matter. European Journal of Information

Systems, 24(3), 247–261.

Zhu, Z., Nakata, C., Sivakumar, K., & Grewal, D. (2013). Fix it or leave it? Customer

recovery from self-service technology failures. Journal of Retailing, 89(1), 15–29.

R. Sharma, et al. International Journal of Information Management 53 (2020) 102116

13