Résumé :

Despite the steady growth of Internet banking and mobile banking, only half of adults in the U.S.

use online banking, with the other half still visiting physical branches for their banking services

(Fox, 2013). For years, studies are being conducted in the IS field using the Technology

Acceptance Model (TAM) in order to determine the key factors explaining the adoption of online

banking. But, due to the privacy concerns and the psychological barriers often associated with

conducting transactions in a virtual world, the TAM has proven to be a limited tool. In this study,

we revisited the IS literature on mobile banking adoption along with relevant theories from the

areas of marketing and psychology in order to develop a conceptual model that would have a

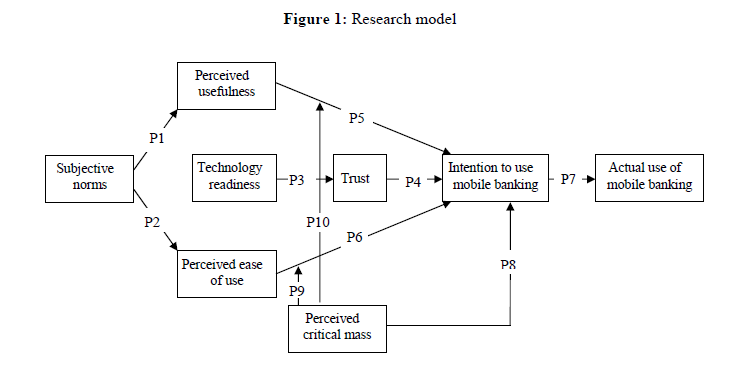

potentially greater explanation power. The proposed model emphasizes the role of subjective

norms, technological readiness, trust, and perceived critical mass of users. The model is

discussed along with the research propositions it implies. The theoretical and practical

implications of the study are also discussed.

Mots-clés : mobile banking, technology adoption, technology readiness, perceived critical mass

A noter : l’article présente le modèle conceptuel suivant mais ne présente pas de méthodologie de recherche.

Bibliographie :

Ajzen, I. (1991). The theory of planned behavior. Organizational behavior and human decision

processes, 50(2), 179-211.

Amin, H. (2007). Internet banking adoption among young intellectuals. Journal of Internet

Banking & Commerce, 12(3), 1-13.

Ayers, D. J., Menachemi, N., Ramamonjiarivelo, Z., Matthews, M., & Brooks, R. G. (2009).

Adoption of electronic medical records: The role of network effects. Journal of Product

& Brand Management, 18(2), 127–135. doi:10.1108/10610420910949022

Barki, H., & Hartwick, J. (1994). Measuring user participation, user involvement, and user

attitude. MIS Quarterly, 18(1), 59-82. doi:10.2307/249610

Chiou, J. -S., & Shen, C. -C. (2012). The antecedents of online financial service adoption: The

impact of physical banking services on Internet banking acceptance. Behaviour and

Information Technology, 31(9), 859-871. doi:10.1080/0144929X.2010.549509

Cho, H. (2011). Theoretical intersections among social influences, beliefs, and intentions in the

context of 3G mobile services in Singapore: Decomposing perceived critical mass and

subjective norms. Journal of Communication, 61(2), 283-306.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of

information technology. MIS quarterly, 13(3), 319-340.

Doney, P. M., & Cannon , J. P. (1997). An examination of the nature of trust in buyer-seller

relationships. Journal of Marketing, 61(2), 35-51.

Elliott, K. M., Meng, J., & Hall, M. C. (2008). Technology readiness and the likelihood to use

self-service technology: Chinese vs. American consumers. Marketing Management

Journal, 18(2), 20-31.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to

theory and research. Reading, Mass. : Addison-Wesley Pub. Co.

Fox, S. (2013, August 7). 51% of U.S. Adults Bank Online. Retrieved from Pew Research Center:

http://www.pewinternet.org/2013/08/07/51-of-u-s-adults-bank-online/

Grabner-Kraeuter, S. (2002). The role of consumers’ trust in online-shopping. Journal of

Business Ethics, 39(1-2), 43-50.

Griskevicius, V., Goldstein, N. J., Mortensen, C. R., Cialdini, R. B., & Kenrick, D. T. (2006).

Going along versus going alone: When fundamental motives facilitate strategic (non)

conformity. Journal of personality and social psychology, 91(2), 281-294.

Homburg, C., Wieseke, J., & Kuehnl, C. (2010). Social influence on salespeople’s adoption of

sales technology: A multilevel analysis. Journal of the Academy of Marketing Science,

38(2), 159-168. doi:10.1007/s11747-009-0157-x

Karahanna, E., & Straub, D. W. (1999). The psychological origins of perceived usefulness and

ease-of-use. Information & Management, 35(4), 237-250.

Kesharwani, A., & Bisht, S. S. (2012). The impact of trust and perceived risk on internet banking

adoption in India: An extension of technology acceptance model. International Journal of

Bank Marketing, 30(4), 303–322. doi:10.1108/02652321211236923

Kraut, R., Patterson, M., Lundmark, V., Kiesler, S., Mukophadhyay, T., & Scherlis, W. (1998).

Internet paradox: A social technology that reduces social involvement and psychological

well-being? American Psychologist, 53(9), 1017–1031. doi:10.1037/0003-

066x.53.9.1017

Journal of Management Information and Decision Sciences Volume 18, Number 1, 2015

120

Legris, J. Ingham, P. Collerette (2003). Why do people use information technology? A critical

review of the technology acceptance model, Information & Management, 40, 191–204

Lou, H., Luo, W., & Strong, D. (2000). Perceived critical mass effect on groupware acceptance.

European Journal of Information Systems, 9(2), 91-103.

doi:10.1057/palgrave.ejis.3000358

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational

trust. Academy of Management Review, 20(3), 709-734.

McKechnie, S., Winklhofer, H., & Ennew, C. (2006). Applying the technology acceptance.

International Journal of Retail & Distribution Management, 34(4), 388–410.

doi:10.1108/09590550610660297

Mustonen-Ollila, E., & Lyytinen, K. (2003). Why organizations adopt information system

process innovations: A longitudinal study using Diffusion of Innovation theory.

Information Systems Journal, 13(3), 275-297. doi:10.1046/j.1365-2575.2003.00141.x

Parasuraman, A. (2000). Technology Readiness Index (TRI): A multiple-item scale to measure

readiness to embrace new technologies. Journal of Service Research, 2(4), 307–320.

doi:10.1177/109467050024001

Roca, J. C., García, J. J., & de la Vega, J. J. (2009). The importance of perceived trust, security

and privacy in online trading systems. Information Management & Computer Security,

17(2), 96-113. doi:10.1108/09685220910963983

Rogers, E. M. (1995). Diffusion of innovations (4th ed.). New York: Free Press.

Schmitz, J., & Fulk, J. (1991). Organizational colleagues, media richness, and electronic mail: A

test of the social influence model of technology use. Communication Research, 18(4),

487–523. doi:10.1177/009365091018004003

Shen, Y. C., Huang, C. -Y., Chu, C. -H., & Hsu, C. -T. (2010). A benefit–cost perspective of the

consumer adoption of the mobile banking system. A benefit–cost perspective of the

consumer adoption of the mobile banking system, 29(5), 497–511.

doi:10.1080/01449290903490658

Singer, D. D., Baradwaj, B. G., Flaherty, S., & Rugemer, F. (2012). The frequency and intensity

of experience in online banking use. Journal of Internet Banking & Commerce, 17(1), 1-

22.

Sledgianowski, D., & Kulviwat, S. (2009). Using social network sites: The effects of playfulness,

critical mass and trust in a hedonic context. Journal of Computer Information Systems,

49(4), 74-83.

Strader, T. J., Ramaswami, S. N., & Houle, P. A. (2007). Perceived network externalities and

communication technology acceptance. European Journal of Information Systems, 16(1),

54–65. doi:10.1057/palgrave.ejis.3000657

Teo, T. (2010). A path analysis of pre-service teachers’ attitudes to computer use: Applying and

extending the technology acceptance model in an educational context. Interactive

Learning Environments, 18(1), 65-79. doi:10.1080/10494820802231327

Vatanasombut, B., Igbaria, M., Stylianou, A. C., & Rodgers, W. (2008). Information systems

continuance intention of web-based applications customers: The case of online banking.

Information & Management, 45(7), 419–428. doi:10.1016/j.im.2008.03.005

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance

model: Four longitudinal field studies. Management science, 46(2), 186-204.

doi:10.1287/mnsc.46.2.186.11926

Journal of Management Information and Decision Sciences Volume 18, Number 1, 2015

121

Wang, S. W., Hsu, M. K., Pelton, L. E., & Xi, D. (2014). Virtually compatible or risky business?

Investigating consumers’ proclivity toward online banking services. Journal of Marketing

Channels, 21(1), 43–58. doi:10.1080/1046669x.2013.832466

Wang, Y. -S., Wang, Y. -M., Lin, H. -H., & Tang, T. -T. (2003). Determinants of user

acceptance of Internet banking: An empirical study. International Journal of Service

Industry Management, 14(5), 501–519. doi:10.1108/09564230310500192

Yu, C. (2012). Factors affecting individuals to adop mobile banking: empirical evidence from the

UTAUT model. Journal of Electronic Commerce Research, 3(2), 104-121.

Zhu, J. H., & He, Z. (2002). Perceived characteristics, perceived needs, and perceived popularity:

Adoption and use of the Internet in China. Communication Research, 29(4), 466–495.

doi:10.1177/0093650202029004005

Journal of Management Information and Decision Sciences Volume 18, Number 1, 2015

122