Résumé :

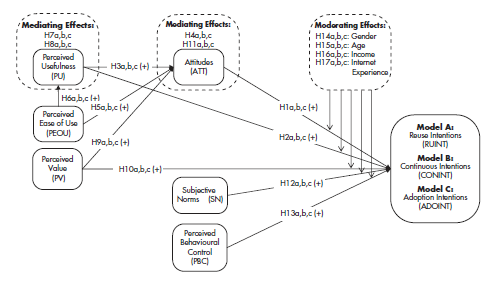

Despite the surge in interest in research on customers’ adoption of

internet banking (IB), how discontinued users can be brought back to IB has not

received much attention. To respond to this question and to provide a

comprehensive understanding of IB customer behaviour, we develop a

conceptual model grounded on the extended technology acceptance model, and

empirically validate it using a sample of 614 IB customers (including those yet to

adopt, current users and discontinued users) from China. Perceived value is the

most important driver for explaining all categories of customers’ IB-related

behaviours. Banks that implement measures that aim to increase the perceived

usefulness of IB and enhance the value of IB are likely to be rewarded with

increasing IB adoption amongst its customer base.

Mots-clés : Internet banking behavious, deiscontinued users, technology acceptance model

Model conceptuel :

Méthodologie de recherche :

Data, using questionnaires, was collected for the three different categories of IB users

from urban Chinese bank customers who are also users of the Internet.

Data was analysed using the Partial Least Squares (PLS) approach for structural

equation modelling.

Bibliographie :

Abu-Shanab, E. (2013). Income divide: A determinant of technology acceptance. International

Arab Journal of e-Technology, 3, 121–127. Retrieved from http://www.iajet.org/iajet_files/vol.3/

no.2/Income%20Divide_%20a%20Determinant%20of%20Technology%20Acceptance.pdf

Abushanab, E., & Pearson, J. M. (2007). Internet banking in Jordan: The unified theory of

acceptance and use of technology (UTAUT) perspective. Journal of Systems and Information

Technology, 9, 78–97. doi:10.1108/13287260710817700

Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In J. Kuhl & J.

Beckmann (Eds.), Action control: From cognition to behavior (pp. 11–35). Berlin: Springer-

Verlag.

Ajzen, I. (1988). Attitudes, personality, and behavior. Milton Keynes: Open University Press.

Alsajjan, B., & Dennis, C. (2010). Internet banking acceptance model: Cross-market

examination. Journal of Business Research, 63, 957–963. doi:10.1016/j.jbusres.2008.12.014

Al-Smadi, M. O. (2012). Factors affecting adoption of electronic banking: An analysis of the

perspectives of banks’ customers. International Journal of Business and Social Science, 3,

294–309. Retrieved from http://connection.ebscohost.com/c/articles/87607373/factorsaffecting-

adoption-electronic-banking-analysis-perspectives-banks-customers

Al-Somali, S. A., Gholami, R., & Clegg, B. (2009). An investigation into the acceptance of

online banking in Saudi Arabia. Technovation, 29, 130–141. doi:10.1016/j.

technovation.2008.07.004

Wu et al. A comprehensive examination of internet banking user behaviour 1029

Analysys International. (2010). The centralization of China online banking market is increased,

ICBC and CBC occupy 59% in Q1, 2010. Retrieved from http://english.analysys.com.cn/

article.php?aid=90903

Baumgartner, H., & Homburg, C. (1996). Applications of structural equation modeling in

marketing and consumer research: A review. International Journal of Research in Marketing,

13, 139–161. doi:10.1016/0167-8116(95)00038-0

Benbasat, I., & Barki, H. (2007). Quo Vadis, TAM? Journal of the Association for Information

Systems, 8, 211–218. Retrieved from http://aisel.aisnet.org/jais/vol8/iss4/16

Çelik, H. (2008). What determines Turkish customers’ acceptance of internet banking?

International Journal of Bank Marketing, 26, 353–370. doi:10.1108/02652320810894406

Chan, R. Y., & Lau, L. (1998). A test of the Fishbein-Ajzen behavioral intentions model under

Chinese cultural settings: Are there any differences between PRC and Hong Kong

consumers? Journal of Marketing Practice: Applied Marketing Science, 4, 85–101.

doi:10.1108/EUM0000000004490

Chan, S., & Lu, M. (2004). Understanding internet banking adoption and use behavior: A

Hong Kong perspective. Journal of Global Information Management, 12, 21–43.

doi:10.4018/jgim.2004070102

Chang, H. H., & Wang, H. (2011). The moderating effect of customer perceived value on

online shopping behaviour. Online Information Review, 35(3), 333–359. doi:10.1108/

14684521111151414

Chau, V. S., & Ngai, L. W. L. C. (2010). The youth market for internet banking services:

Perceptions, attitude and behaviour. Journal of Services Marketing, 24(1), 42–60.

doi:10.1108/08876041011017880

Cheng, T. C. E., Lam, D. Y. C., & Yeung, A. C. L. (2006). Adoption of internet banking: An

empirical study in Hong Kong. Decision Support Systems, 42, 1558–1572. doi:10.1016/j.

dss.2006.01.002

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. In A.

M. George (Eds.), Modern methods for business research (pp. 295–336). Mahwah, NJ:

Lawrence Erlbaum Associates.

Chin, W. W. (2010). How to write up and report PLS analyses. In V. E. Vinzi, W. W. Chin, J.

Henseler, & H. Wand (Eds.), Handbook of partial least square: Concepts, methods and

applications (pp. 655–689). Berlin: Springer.

China Financial Certification Authority [CFCA]. (2013). 2013 Report on electronic banking in

China. Beijing: Author.

China Internet Network Information Centre [CNNIC]. (2013). Statistical report on internet

development in China. Retrieved from http://www1.cnnic.cn/IDR/ReportDownloads/

201302/P020130221391269963814.pdf

Chong, A. Y., Ooi, K., Lin, B., & Tan, B. (2010). Online banking adoption: An empirical

analysis. International Journal of Bank Marketing, 28, 267–287. doi:10.1108/

02652321011054963

Cronin Jr., J. J., Brady, M. K., Brand, R. R., Hightower Jr., R., & Shemwell, D. J. (1997). A

cross-sectional test of the effect and conceptualization of service value. Journal of Services

Marketing, 11, 375–391. doi:10.1108/08876049710187482

Davies, H., Leung, T. K., Luk, S. T. K., & Wong, Y. (1995). The benefits of ‘Guanxi’: The value

of relationships in developing the Chinese market. Industrial Marketing Management, 24(3),

207–214. doi:10.1016/0019-8501(94)00079-C

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of

information technology. MIS Quarterly, 13, 319–340. doi:10.2307/249008

Davis, F. D. (1993). User acceptance of information technology: System characteristics, user

perceptions and behavioral impacts. International Journal of Man-Machine Studies, 38,

475–487. doi:10.1006/imms.1993.1022

1030 Journal of Marketing Management, Volume 30

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology:

A comparison of two theoretical models. Management Science, 35, 982–1003. doi:10.1287/

mnsc.35.8.982

Dean, D. H. (2008). Shopper age and the use of self-service technologies. Managing Service

Quality, 18, 225–238. doi:10.1108/09604520810871856

Deng, Z., Lu, Y., Wei, K. K., & Zhang, J. (2010). Understanding customer satisfaction and

loyalty: An empirical study of mobile instant messages in China. International Journal of

Information Management, 30, 289–300. doi:10.1016/j.ijinfomgt.2009.10.001

Dodds, W. B., Monroe, K. B., & Grewal, D. (1991). Effects of price, brand, and store

information on buyers’ product evaluations. Journal of Marketing Research, 28, 307–319.

doi:10.2307/3172866

Eggert, A., & Ulaga, W. (2002). Customer perceived value: A substitute for satisfaction in

business markets? Journal of Business & Industrial Marketing, 17, 107–118. doi:10.1108/

08858620210419754

Eriksson, K., Kerem, K., & Nilsson, D. (2005). Customer acceptance of internet banking in

Estonia. International Journal of Bank Marketing, 23, 200–216. doi:10.1108/

02652320510584412

Eriksson, K., Kerem, K., & Nilsson, D. (2008). The adoption of commercial innovations in

the former central and eastern European markets: The case of internet banking in Estonia.

International Journal of Bank Marketing, 26, 154–169. doi:10.1108/

02652320810864634

Eriksson, K., & Nilsson, D. (2007). Determinants of the continued use of self-service

technology: The case of internet banking. Technovation, 27, 159–167. doi:10.1016/j.

technovation.2006.11.001

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to

theory and research. Boston, MA: Addison-Wesley.

Flavián, C., Guinalíu, M., & Torres, E. (2006). How bricks-and-mortar attributes affect online

banking adoption. International Journal of Bank Marketing, 24, 406–423. doi:10.1108/

02652320610701735

Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS

applied to consumer exit-voice theory. Journal of Marketing Research, 19, 440–452.

doi:10.2307/3151718

Froehle, C. M., & Roth, A. V. (2004). New measurement scales for evaluating perceptions of

the technology-mediated customer service experience. Journal of Operations Management,

22, 1–21. doi:10.1016/j.jom.2003.12.004

Gallarza, M. G., & Saura, I. G. (2006). Value dimensions, perceived value, satisfaction and

loyalty: An investigation of university students’ travel behaviour. Tourism Management, 27,

437–452. doi:10.1016/j.tourman.2004.12.002

Gefen, D. (2003). TAM or just plain habit: A look at experienced online shoppers. Journal of

Organizational and End User Computing, 15(3), 1–13. doi:10.4018/joeuc.2003070101

Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61,

101–107. doi:10.1093/biomet/61.1.101

Gerrard, P., Cunningham, J. B., & Devlin, J. F. (2006). Why consumers are not using internet

banking: A qualitative study. Journal of Services Marketing, 20, 160–168. doi:10.1108/

08876040610665616

Henseler, J., Ringle, C. M., & Sinkovices, R. R. (2009). The use of partial least squares path

modeling in international marketing. Advances in International Marketing, 20, 277–319.

doi:10.1108/S1474-7979(2009)0000020014

Hernandez, J. M., & Mazzon, J. A. (2007). Adoption of internet banking: Proposition and

implementation of an integrated methodology approach. International Journal of Bank

Marketing, 25, 72–88. doi:10.1108/02652320710728410

Wu et al. A comprehensive examination of internet banking user behaviour 1031

Hitt, L. M., Xue, M., & Chen, P. (2007). The determinants and outcomes of internet banking

adoption. MSI Working Paper Series, (4), 99–122. Retrieved from http://www.msi.org/

reports/the-determinants-and-outcomes-of-internet-banking-adoption/

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions, and

organizations across nations. Thousand Oaks, CA: Sage.

Hua, G. (2009). An experimental investigation of online banking adoption in China. Journal of

Internet Banking and Commerce, 14(1), 1–12. Retrieved from http://aisel.aisnet.org/

amcis2008/36/

iResearch. (2013). 2012–2013 Annual report on internet banking in China. Retrieved from

http://report.iresearch.cn/1987.html

Jackson, C. M., Chowand, S., & Leitch, R. A. (1997). Toward an understanding of the

behavioral intention to use an information system. Decision Sciences, 28, 357–389.

doi:10.1111/j.1540-5915.1997.tb01315.x

Karjaluoto, H., Mattila, M., & Pento, T. (2002). Factors underlying attitude formation towards

online banking in Finland. International Journal of Bank Marketing, 20, 261–272.

doi:10.1108/02652320210446724

Kim, H. W., Chan, H. C., & Gupta, S. (2007). Value-based adoption of mobile internet: An

empirical investigation. Decision Support Systems, 43, 111–126. doi:10.1016/j.

dss.2005.05.009

Koenig-Lewis, N., Palmer, A., & Moll, A. (2010). Predicting young consumers’ take up of

mobile banking services. International Journal of Bank Marketing, 28, 410–432.

doi:10.1108/02652321011064917

Kolodinsky, J. M., Hogarth, J. M., & Hilgert, M. A. (2004). The adoption of electronic

banking technologies by US consumers. International Journal of Bank Marketing, 22,

238–259. doi:10.1108/02652320410542536

Konus, U., Verhoef, P. C., & Neslin, S. A. (2008). Multichannel shopper segments and their

covariates. Journal of Retailing, 84(4), 398–413. doi:10.1016/j.jretai.2008.09.002

Laforet, S., & Li, X. (2005). Consumers’ attitudes towards online and mobile banking in

China. International Journal of Bank Marketing, 23, 362–380. doi:10.1108/

02652320510629250

Ledden, L., Kalafatis, S. P., & Samouel, P. (2007). The relationship between personal values and

perceived value of education. Journal of Business Research, 60, 965–974. doi:10.1016/j.

jbusres.2007.01.021

Lee, M. (2009). Factors influencing the adoption of internet banking: An integration of TAM

and TPB with perceived risk and perceived benefit. Electronic Commerce Research and

Applications, 8, 130–141. doi:10.1016/j.elerap.2008.11.006

Levy, J. A. (1988). Intersections of gender and aging. The Sociological Quarterly, 29, 479–486.

doi:10.1111/j.1533-8525.1988.tb01429.x

Lewis, B. R., & Soureli, M. (2006). The antecedents of consumer loyalty in retail banking.

Journal of Consumer Behaviour, 5, 15–31. doi:10.1002/cb.46

Li, D., Browne, G. J., & Chau, P. Y. K. (2006). An empirical investigation of web site use using

a commitment-based model. Decision Sciences, 37, 427–444. doi:10.1111/j.1540-

5414.2006.00133.x

Liang, H., Saraf, N., Hu, Q., & Xue, Y. (2007). Assimilation of enterprise systems: The effect

of institutional pressures and the mediating role of top management. MIS Quarterly, 31(1),

59–87. Retrieved from http://misq.org/assimilation-of-enterprise-systems-the-effect-ofinstitutional-

pressures-and-the-mediating-role-of-top-management.html

Lu, J., Yao, J. E., & Yu, C. (2005). Personal innovativeness, social influences and adoption of

wireless internet services via mobile technology. The Journal of Strategic Information

Systems, 14, 245–268. doi:10.1016/j.jsis.2005.07.003

1032 Journal of Marketing Management, Volume 30

Luarn, P., & Lin, H. (2005). Toward an understanding of the behavioral intention to use

mobile banking. Computers in Human Behavior, 21, 873–891. doi:10.1016/j.

chb.2004.03.003

Nilsson, D. (2007). A cross-cultural comparison of self-service technology use. European

Journal of Marketing, 41(3/4), 367–381. doi:10.1108/03090560710728381

Park, J., Yang, S., & Lehto, X. (2007). Adoption of mobile technologies for Chinese

consumers. Journal of Electronic Commerce Research, 8, 196–206. Retrieved from http://

www.csulb.edu/journals/jecr/issues/20073/Paper3.pdf

Parthasarathy, M., & Bhattacherjee, A. (1998). Understanding post-adoption behavior in the

context of online services. Information Systems Research, 9, 362–379. doi:10.1287/

isre.9.4.362

Peak, H. (1955). Attitude and motivation. In M. R. Jones (Ed.), Nebraska sympos on

motivation (pp. 149–188). Lincoln, NE: University of Nebraska Press.

Podsakoff, P. M., Mackenzie, S. B., Lee, R. H., & Podsakoff, R. (2003). Common method

biases in behavioral research: A critical review of the literature and recommended remedies.

Journal of Applied Psychology, 88, 879–903. doi:10.1037/0021-9010.88.5.879

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: Problems and

prospects. Journal of Management, 12, 531–544. doi:10.1177/014920638601200408

Ringle, C. M., Wende, S., & Will, A. (2005). SmartPLS (2.0 beta). Retrieved from http://

smartpls.de

Riquelme, H. E., & Rios, R. E. (2010). The moderating effect of gender in the adoption of

mobile banking. International Journal of Bank Marketing, 28, 328–341. doi:10.1108/

02652321011064872

Rosenberg, M. J. (1956). Cognitive structure and attitudinal affect. The Journal of Abnormal

and Social Psychology, 53, 367–372. doi:10.1037/h0044579

Safeena, R., Date, H., Hundewale, N., & Kammani, A. (2013). Combination of TAM and TPB

in internet banking adoption. International Journal of Computer Theory and Engineering, 5,

146–150. doi:10.7763/IJCTE.2013.V5.665

Salisbury, W. D., Pearson, R. A., Pearson, A. W., & Miller, D. W. (2001). Perceived security and

world wide web purchase intention. Industrial Management & Data Systems, 101, 165-177 doi:10.1108/02635570110390071

Sawyer, A. G., Worthing, P. M., & Sendak, P. E. (1979). The role of laboratory experiments to

test marketing strategies. Journal of Marketing, 43(3), 60. doi:10.2307/1250147

Sheth, J. N., Newman, B. I., & Gross, B. L. (1991). Consumption values and market choices:

Theory and applications. Cincinnati, OH: South-Western Publishing.

Shih, Y., & Fang, K. (2004). The use of a decomposed theory of planned behavior to study

internet banking in Taiwan. Internet Research, 14, 213–223. doi:10.1108/

10662240410542643

Simon, F., & Usunier, J. (2007). Cognitive, demographic, and situational determinants of

service customer preference for personnel-in-contact over self-service technology.

International Journal of Research in Marketing, 24, 163–173. doi:10.1016/j.

ijresmar.2006.11.004

Sirdeshmukh, D., Singh, J., & Sabol, B. (2002). Consumer trust, value, and loyalty in relational

exchanges. Journal of Marketing, 66(1), 15–37. doi:10.1509/jmkg.66.1.15.18449

Spiller, J., Vlasic, A., & Yetton, P. (2007). Post-adoption behavior of users of internet service

providers. Information & Management, 44, 513–523. doi:10.1016/j.im.2007.01.003

Stone, M. (1974). Cross-validatory choice and assessment of statistical predictions. Journal of

the Royal Statistical Society, 36, 111–147. Retrieved from http://www.stat.washington.edu/

~ebfox/courses/stat527/s13/readings/Stone1974.pdf

Wu et al. A comprehensive examination of internet banking user behaviour 1033

Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of internet banking.

Electronic Commerce Research and Applications, 1, 247–263. doi:10.1016/S1567-4223

(02)00017-0

Swanson, E. B. (1982). Measuring user attitudes in MIS research: A review. The International

Journal of Management Science, 10, 157–165. doi:10.1016/0305-0483(82)90050-0

Taylor, S., & Todd, P. (1995a). Assessing IT usage: The role of prior experience. MIS Quarterly,

19, 561–570. doi:10.2307/249633

Taylor, S., & Todd, P. (1995b). Decomposition and crossover effects in the theory of planned

behavior: A study of consumer adoption intentions. International Journal of Research in

Marketing, 12, 137–155. doi:10.1016/0167-8116(94)00019-k

Taylor, S., & Todd, P. (1995c). Understanding information technology usage: A test of

competing models. Information Systems Research, 6, 144–176. doi:10.1287/isre.6.2.144

Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4, 199–214.

doi:10.1287/mksc.4.3.199

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance

model: Four longitudinal field studies. Management Science, 46, 186–204. doi:10.1287/

mnsc.46.2.186.11926

Vroom, V. H. (1964). Work and motivation. New York, NY: Wiley.

Wan, W. W. N., Luk, C. L., & Chow, C. W. C. (2005). Customers’ adoption of banking

channels in Hong Kong. The International Journal of Bank Marketing, 23, 255–272.

doi:10.1108/02652320510591711

Wang, H., & Yang, H. (2006). Do personality traits affect the acceptance of e-finance?

International Journal of Electronic Finance, 1, 200–221. doi:10.1504/IJEF.2006.010316

Wessels, L., & Drennan, J. (2010). An investigation of consumer acceptance of M-banking.

International Journal of Bank Marketing, 28, 547–568. doi:10.1108/02652321011085194

Yoon, H. S., & Steege, L. M. B. (2013). Development of a quantitative model of the impact of

customers’ personality and perceptions on internet banking use. Computers in Human

Behavior, 29, 1133–1141. doi:10.1016/j.chb.2012.10.005

Yousafzai, S., & Yani-de-Soriano, M. (2012). Understanding customer-specific factors

underpinning internet banking adoption. International Journal of Bank Marketing, 30(1),

60–81. doi:10.1108/02652321211195703

Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: A means-end model

and synthesis of evidence. Journal of Marketing, 52(3), 2–22. doi:10.2307/1251446

Zhao, A. L., Hanmer-Lloyd, S., Ward, P., & Goode, M. M. H. (2008). Perceived risk and

Chinese consumers’ internet banking services adoption. International Journal of Bank

Marketing, 26, 505–525. doi:10.1108/02652320810913864

Zhao, A. L., Koenig-Lewis, N., Hanmer-Lloyd, S., & Ward, P. (2010). Adoption of internet

banking services in China: Is it all about trust? International Journal of Bank Marketing, 28,

7–26. doi:10.1108/02652321011013562

Zhu, J. J. H., & He, Z. (2002). Perceived characteristics, perceived needs, and perceived

popularity: Adoption and use of the internet in China. Communication Research, 29,

466–495. doi:10.1177/0093650202029004005