Résumé :

The internet and its accompanying technologies regarding the e-bank

industry’s products and services have been diversified in relations to customers’ needs

and desires. In spite of improved quality of service delivery on banker-customer

transactions facilitated by the increasing levels of adoption and use of new

technologies, important variables that inhibit customers in their quest to engage in

successful online banking transactions have been silent in the context of some

emerging economies. Against this backdrop, the focus of the study was aimed at

reviewing the antecedents and investigating the barriers of internet banking adoption

and acceptance from an emerging economy perspective. Document Analysis (DA) as a

research technique for executing the general aim of the study was employed. The study

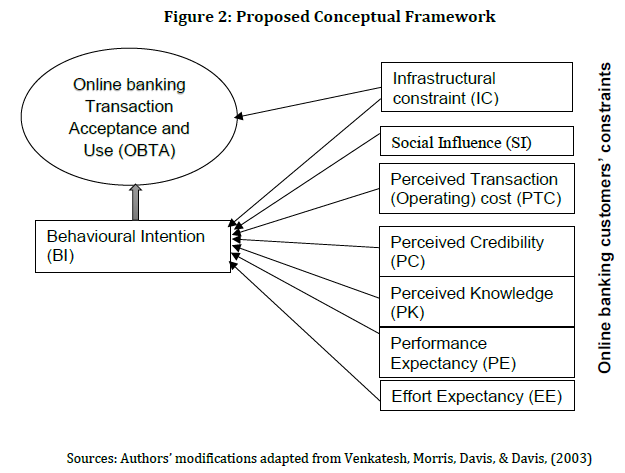

presents and highlights the leading constraints of online banking transaction adoption,

notably; Infrastructural constraint, Behavioral Influence, Social Influence, Operating

(Transaction) Cost, Perceived Credibility, Performance Expectancy, Effort Expectancy,

and Perceived Knowledge were discovered as online banking customers’ constraints.

In theory, the study adds up to broaden the scope of internet marketing in banking

from the perspectives of consumer behaviour in online banking transactions. The

practical knowledge will help practitioners and industry players in the banking

fraternity to strategize and repose confidence in customers in their quest to engage in

online banking transactions.

Mots-clés : customer’s risk, online banking transaction, technology adoption, emerging economies

Adoption and acceptance model of Internet Banking from the Literature

Methodology : the researchers employ document analysis (DA) as the research technique.

Conceptual Framework :

Conclusion :

The study was aimed at reviewing the antecedence and barriers of internet

banking adoption and acceptance from an emerging economy’s perspective. Document

Analysis (DA) as a research technique for executing the general aim of the study was

employed. The study presents and highlights the antecedence of online banking

transaction adoption specifically infrastructural constraint, behavioral influence, social

influence, operating(transaction) cost, perceived credibility, Performance Expectancy

(PE) and perceived knowledge were discovered as online banking customers’

constraints. In theory, the study adds up to broaden the scope of internet marketing

(banking) given the interplay of consumer behavior in the online banking transaction.

The practical knowledge will help practitioners and industry players in the banking

fraternity to strategize and repose confidence in customers in their quest to engage in

online banking transactions.

Bibliographie :

Ahmad, D. T., & Hariri, M. (2012). User Acceptance of Biometrics in E-banking to improve

Security. Business Management Dynamics, 2(1), 1.

• Aliyu, A. A., Rosmain, T., & Takala, J. (2014). Online banking and customer service delivery in Malaysia: data screening and preliminary findings. Procedia-Social and Behavioral Sciences, 129, 562–570.

• Bandura, A. (1989). Human agency in social cognitive theory. American Psychologist, 44(9), 1175.

• Bandura, A. (2001). Social cognitive theory: An agentic perspective. Annual Review of

Psychology, 52(1), 1–26.

• BUZZ GHANA. Top 10 Banks in Ghana. By Chuka Obiorah https://buzzghana.com/top-10-

biggest-banks-ghana/[online] Retrieved on: 07/03/2019

• Dauda, S. Y., & Lee, J. (2015). Technology adoption: A conjoint analysis of consumers ׳

preference on future online banking services. Information Systems, 53, 1–15.

• Davis, F. D. (1993). User acceptance of information technology: system characteristics, user perceptions and behavioral impacts. International journal of man-machine studies, 38(3),

475-487.

• Davis, F. D., & Venkatesh, V. (1996). A critical assessment of potential measurement biases in the technology acceptance model: three experiments. International journal of humancomputer studies, 45(1), 19-45.

• Ernst & Young. (2011). The digitisation of everything. Retrieved from

http://www.ey.com/Publication/vwLUAssets/The_digitisation_of_everything_-

How_organisations_must_adapt_to_changing_consumer_behaviour/$FILE/EY_Digitisation_of

everything.pdf

• Fishbein, M., & Ajzen, I. (1975). Intention and Behavior: An introduction to theory and

research.

• Fishbein, M., Jaccard, J., Davidson, A. R., Ajzen, I., & Loken, B. (1980). Predicting and

understanding family planning behaviors. In Understanding attitudes and predicting social

behavior. Prentice Hall.

• Fusilier, M., & Durlabhji, S. (2005). An exploration of student internet use in India: the

technology acceptance model and the theory of planned behaviour. Campus-Wide Information Systems, 22(4), 233–246.

• Hamid, M. R. A., Amin, H., Lada, S., & Ahmad, N. (2007). A comparative analysis of Internet banking in Malaysia and Thailand. Journal of Internet Business, (4).

• Hanafizadeh, P., Keating, B. W., & Khedmatgozar, H. R. (2014). A systematic review of Internet banking adoption. Telematics and Informatics, 31(3), 492–510.

• Igbaria, M., Parasuraman, S., & Baroudi, J. J. (1996). A motivational model of microcomputer usage. Journal of Management Information Systems, 13(1), 127–143.

• Im, I., Hong, S., & Kang, M. S. (2011). An international comparison of technology adoption:

Testing the UTAUT model. Information & Management, 48(1), 1–8.

• Kesharwani, A., & Singh Bisht, S. (2012). The impact of trust and perceived risk on internet

banking adoption in India: An extension of technology acceptance model. International

Journal of Bank Marketing, 30(4), 303–322.

• Legris, P., Ingham, J., & Collerette, P. (2003). Why do people use information technology? A critical review of the technology acceptance model. Information & Management, 40(3), 191–

204.

• Liska, A. E. (1984). A critical examination of the causal structure of the Fishbein/Ajzen

attitude-behavior model. Social Psychology Quarterly, 61–74.

• López-Nicolás, C., Molina-Castillo, F. J., & Bouwman, H. (2008). An assessment of advanced mobile services acceptance: Contributions from TAM and diffusion theory models.

Information & Management, 45(6), 359–364.

• Martins, C., Oliveira, T., & Popovič, A. (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application.

International Journal of Information Management, 34(1), 1–13.

• Mathieson, K. (1991). Predicting user intentions: comparing the technology acceptance model with the theory of planned behavior. Information Systems Research, 2(3), 173–191.

JOURNAL OF SUSTAINABLE DEVELOPMENT, VOL. 9, ISSUE 23 (2019), 29-43

UDC: 336.71:004.738.5]:366.1

43

• Miltgen, C. L., Popovič, A., & Oliveira, T. (2013). Determinants of end-user acceptance of

biometrics: Integrating the “Big 3” of technology acceptance with privacy context. Decision

Support Systems, 56, 103–114.

• Norman, P., & Smith, L. (1995). The theory of planned behaviour and exercise: An

investigation into the role of prior behaviour, behavioural intentions and attitude variability.

European Journal of Social Psychology, 25(4), 403–415.

• Norton, J. A., & Bass, F. M. (1987). A diffusion theory model of adoption and substitution for successive generations of high-technology products. Management Science, 33(9), 1069–1086.

• Saleem, A., & Higuchi, K. (2014). Globalization and ICT innovation policy: Absorption capacity in developing countries. 16th International Conference on Advanced Communication

Technology, 409–417. IEEE.

• Sarver, V. T. (1983). Ajzen and Fishbein’s” theory of reasoned action”: A critical assessment.

• Sathye, M. (1999). Adoption of Internet banking by Australian consumers: an empirical

investigation. International Journal of Bank Marketing, 17(7), 324–334.

• Shankar, V., & Meyer, J. (2009). The internet and international marketing. In The SAGE

Handbook of International Marketing. https://doi.org/10.4135/9780857021007.n23

• Shankar, V., Smith, A. K., & Rangaswamy, A. (2003). Customer satisfaction and loyalty in online and offline environments. International Journal of Research in Marketing, 20(2), 153–175.

• Sin Tan, K., Choy Chong, S., Lin, B., & Cyril Eze, U. (2009). Internet-based ICT adoption:

evidence from Malaysian SMEs. Industrial Management & Data Systems, 109(2), 224–244.

• Sin Tan, K., Choy Chong, S., Lin, B., & Cyril Eze, U. (2010). Internet-based ICT adoption among SMEs: Demographic versus benefits, barriers, and adoption intention. Journal of Enterprise

Information Management, 23(1), 27–55.

• Sohail, M. S., & Shanmugham, B. (2003). E-banking and customer preferences in Malaysia: An empirical investigation. Information Sciences, 150(3–4), 207–217.

• Stafford, T. F., Stafford, M. R., & Schkade, L. L. (2004). Determining uses and gratifications for the Internet. Decision Sciences, 35(2), 259–288.

• Tan, K. S., & Eze, U. C. (2008). An empirical study of internet-based ICT adoption among

Malaysian SMEs. Communications of the IBIMA, 1(1), 1–12.

• Thambiah, S., Eze, U. C., Tan, K. S., Nathan, R. J., & Lai, K. P. (2010). Conceptual framework for the adoption of Islamic retail banking services in Malaysia. Journal of Electronic Banking

Systems, 2010(1), 1–10.

• Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance

model: Four longitudinal field studies. Management science, 46(2), 186-204.

• Venkatesh, V., & Zhang, X. (2010). Unified theory of acceptance and use of technology: US vs. China. Journal of Global Information Technology Management, 13(1), 5–27.

• Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 425–478.

• Williams, M. D., Rana, N. P., & Dwivedi, Y. K. (2015). The unified theory of acceptance and use of technology (UTAUT): a literature review. Journal of Enterprise Information Management,

28(3), 443-488.

• Williams, R. L., & Cothrel, J. (2000). Four smart ways to run online communities. MIT Sloan Management Review, 41(4), 81.

• Yiu, C. S., Grant, K., & Edgar, D. (2007). Factors affecting the adoption of Internet Banking in Hong Kong—implications for the banking sector. International Journal of Information

Management, 27(5), 336–351.

• Yu, C.-S. (2012). Factors affecting individuals to adopt mobile banking: Empirical evidence

from the UTAUT model. Journal of Electronic Commerce Research, 13(2), 104.

• Zhu, D. H., & Chang, Y. P. (2014). Investigating consumer attitude and intention toward free trials of technology-based services. Computers in Human Behavior, 30, 328–334.